5 Best Physician Mortgage Loan Companies of 2023

LeverageRx helps you find the right lender so you get the best mortgage – Check your rates here.

LeverageRx helps you find the right lender so you get the best mortgage – Check your rates here.

Young doctors tend to have limited savings, no work history and high levels of debt. These things count against you when applying for a conventional mortgage. However, the earning potential and job security of a young doctor is excellent, so the physician mortgage was born.

In order to know which lenders you are eligible for, we need to know more about you.

We’ll ask you where you are buying a home, what your degree is in, how much you want to borrow and what you plan to put down (if anything at all!)

Based on your information, our technology will show you which lenders you are eligible for.

Since no two doctor home loan programs are the same, this step saves you a headache (and time!)

You select lenders you’re interested in and provide contact information so a pre-vetted loan officer can be in touch.

The loan officer will be able to provide you current rate information, answer your questions and pre-approve you for a physician mortgage.

A physician mortgage loan is a homeowner’s loan created for doctors and other medical professionals. This loan is based on the possibility of future income, making it more popular with new physicians with high student loan debt.

Young doctors tend to have limited savings, no work history and high levels of debt. These things count against you when applying for a conventional mortgage. However, the earning potential and job security of a young doctor is excellent, so the physician mortgage was born.

Get Started

A physician mortgage loan is a homeowner’s loan created for doctors and other medical professionals. This loan is based on the possibility of future income, making it more popular with new physicians with high student loan debt.

Doctors face a big challenge in the home-buying process when they’re first starting their careers for one key reason:

Their high debt-to-income ratio due to student loans.

Fortunately, banks now offer a special mortgage loan offering these high earners the potential to buy a house without the conventional requirements.

We call this type of loan a “physician mortgage loan” — AKA: a doctor’s loan.

So how do these loans work?

Can you qualify?

Is it the right choice for you?

We’ll answer these questions and more in this article.

Every bank has its own set of rules for its physician mortgage program. That said, there are a few rules that most banks will follow.

These typical rules include:

Now, let’s talk about the actual loan process.

The process of a physician home loan doesn’t differ much from conventional loans. The biggest difference would be in the questions on the application.

To get a physician loan, you must fill out an application at the bank of your choice. This bank will review the application and perform a credit check. It’ll then extend a preapproval based on your provided information.

With your preapproval in hand, you can locate your desired home with a listing price within your preapproval amount. You can then place a bid on that home with the real estate agent.

If the current homeowner accepts your bid, you can hire a professional to conduct a property appraisal and inspection of the home. You could also complete the title search and land survey.

You’ll move to close if there aren’t any deal-breaking discoveries during that process. Then, once all documents are signed, you’re a proud owner of a home.

The closing costs of a physician mortgage are similar to traditional closing costs.

If you need a more exact figure, check out our article about calculating the closing costs of a physician mortgage loan.

After you’ve paid your closing costs, all you have left is to pay your mortgage through your monthly payments.

These payments will include a portion of the principal and interest. In addition, many mortgages will include monthly taxes and insurance costs.

What’s the difference between physician mortgage loans & conventional mortgage loans? Learn more about each of these two home loan options!

Your profession must meet a few qualifications to qualify for a physician mortgage.

First, the medical professionals applying for this loan shouldn’t be established doctors with their own practice. The point of a physician loan is to help younger doctors who still carry a large medical school debt burden.

For this reason, most banks require physicians or medical professionals to have been in medical school less than ten years ago.

Most physician loans are available for more than just doctors.

This list covers all the professions that could potentially qualify for a doctor’s mortgage loan:

Of course, the exact designations eligible for a physician loan depend on the bank offering the loan.

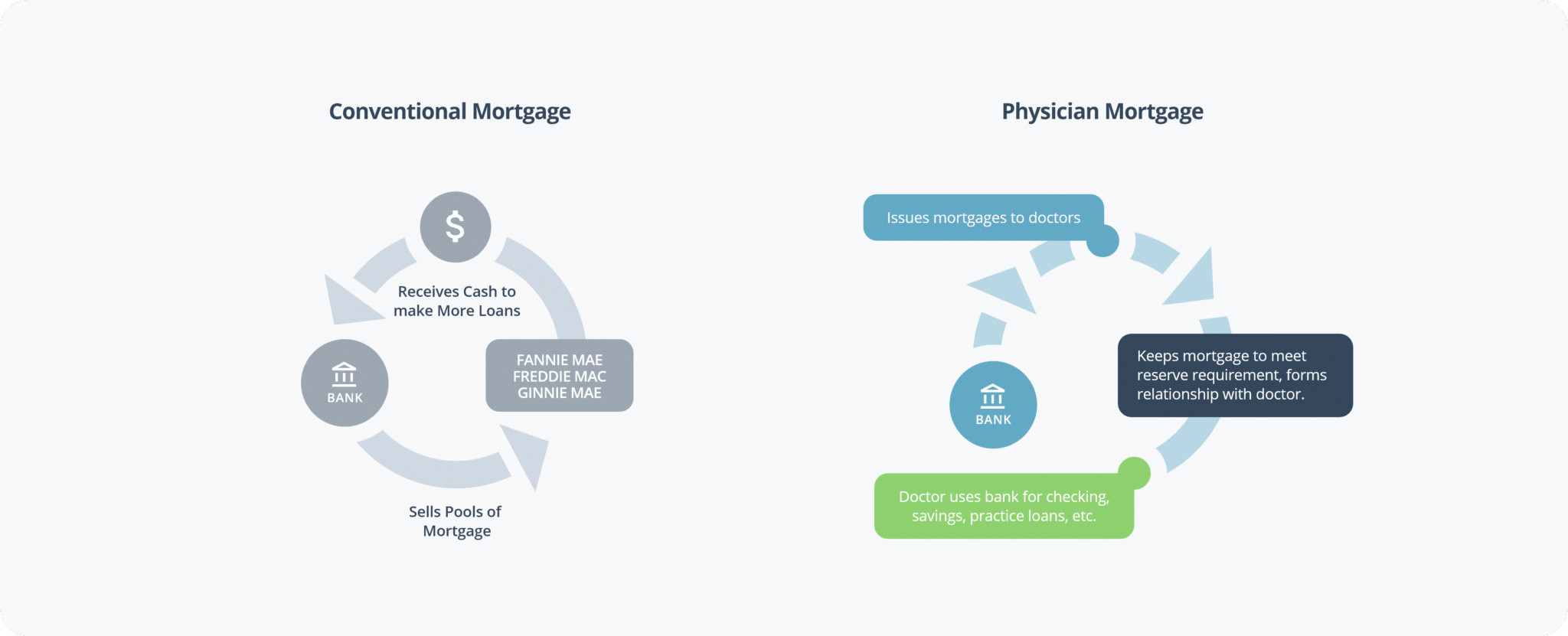

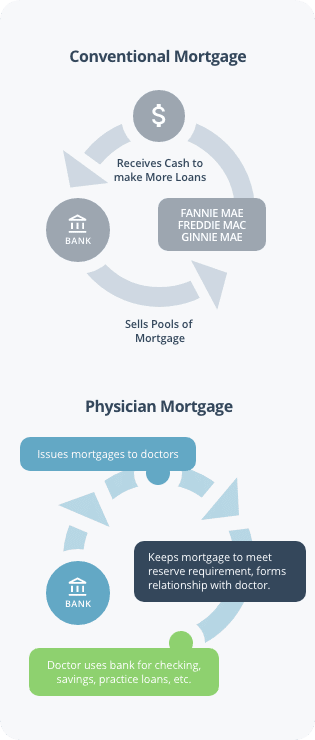

Why would banks offer such a high loan to physicians?

After all, on paper, doctors don’t fit the traditional risk assessment checklist conducted for extending loans.

Lenders offer physician loans for quite a few reasons, such as:

The truth is: doctors are low-risk borrowers.

Healthcare professionals like surgeons and dentists earn high incomes. Therefore, lenders aren’t worried that they can’t afford their payments.

Doctors also have good job security. The nationwide shortage of doctors means they’re in demand and at a low risk of losing their job.

On top of that, many doctors get student loan forgiveness through government programs.

They also tend to buy nicer homes in upscale neighborhoods. These properties are easier to resell if they have to foreclose for any reason.

Medical professionals are high earners who may need a loan again in the future.

Since people tend to return to the bank they know, offering new doctors mortgage loans out of the gate seals the deal for repeat business.

One physician mortgage can become an additional medical practice loan, a second home loan, and even a personal loan for that same lender.

There are many benefits to physician mortgage loans that draw new doctors to use them.

Let’s discuss the most prominent.

The typical down payment for a physician mortgage loan is between 0–5%. This can be very helpful for doctors who don’t have any money in their savings accounts to use for a down payment.

Most physician mortgage loans don’t require PMI. In return, this will lower your monthly mortgage payment amount.

Doctors’ loans have a lower interest rate than most jumbo loans (over $647,200 in most areas).

Physician loan interest rates rely heavily on macroeconomic factors. That includes the federal funds rate and monetary policy in effect when you purchase your home.

Instead of basing payments on a standard amortization schedule, payment amounts depend on the student loans of the doctor.

IDR (income-driven repayment plans) are the most common. With this schedule, payments are lower when you first start out and depend on your income.

When you have a lower payment, this also lowers your debt-to-income ratio.

It will, in effect, increase the amount you can borrow for real estate.

New doctors haven’t secured enough prior employment history for banks to base their income on. So physician mortgage loans will vary based on the amount your employment contract promises — not prior income.

This allows doctors to buy a home before they’ve established consistent income records.

The loan amount extended is dependent on the amount of the down payment.

The down payment options vary and depend on several factors. However, to give an example of how the loan amount can change with the down payment, if you opt for 100% financing, the loan amount usually caps at $1 million.

If you’re willing to put more money down, a loan with just 90% financing could be up to $2 million. Both options beat the typical amount offered through a jumbo loan.

Discover: Do Dentists Qualify for Physician Mortgage Loans?

Although physician mortgages can be a great choice for some, they still have their drawbacks.

Let’s talk about a few of those cons.

Most physician mortgages aren’t fixed-rate loans. Unfortunately, that means the interest rate can rise yearly, making your interest payments higher next year than this year.

When they’re fixed rate, this rate is usually higher than most conventional loans.

Even with expectations to earn a high income, it’s still important to stay within your means.

Physician mortgages make it possible for doctors to purchase a very expensive home before they’re even established.

These loan limits may not coincide with how much you can afford on top of your other living expenses.

Ultimately, doctors need to make sure they can afford their monthly mortgage payments and student loan payments on top of everything else.

Banks reserve this type of loan for first-time buyers. With the goal of helping new doctors own a home, they limit the type of properties that are acceptable.

Unfortunately, most condos and townhomes usually aren’t included in this loan program.

As we’ve discussed, lenders like to extend a loan to doctors buying a property that’s easy to resell. For example, a nice single-family home in a good neighborhood.

Investment properties aren’t included in these loans either. Doctors must intend on living in the home for longer than five years.

Physician mortgages do have some drawbacks. Therefore, it’s also important to consider other mortgage options that could be an alternative to this physician loan program.

Some of the best physician mortgage loan alternatives are:

FHA loans are a good option for first-time home buyers because they allow for a low down payment. It’s also easier to get approval for one, even if you have a low credit score.

Of course, the amount of an FHA loan won’t come close to that of a physician loan, but you can still own a home instead of paying rent.

Also known as piggyback loans, 80/20 loans have a bit of a different setup.

These loans allow home buyers to borrow 80% of the total purchase price through a conventional loan, with the remaining 20% as a home equity line of credit.

The line of credit will come with a significantly higher rate.

You could also opt for an 80/10/10 loan, which is 80% conventional loan, 10% home equity line of credit, and 10% down payment.

Even if the above alternatives aren’t feasible, you can always refinance your physician mortgage loan.

You’ll have more options available to you after:

You can then consider refinancing your physician mortgage loan to a conventional mortgage with a lower fixed rate.

Some mortgage lenders have created a name for themselves as the top providers of physician mortgage loans.

Here’s our roundup of the nine best physician mortgage loan lenders:

This bank offers a great physician mortgage loan program. They offer two different loans: one for residents and new physicians and another for established doctors.

As you can imagine, the loan amount available for established doctors has more flexibility. Yet, both programs offer up to $750,000 with no down payment. You can be eligible for a higher loan with a down payment.

These loans require no PMI, and you can choose from both fixed or adjustable-rate loans.

Read our full Fifth Third Physician Mortgages review.

Bank of America offers a mortgage loan to residents who can close on their loan even 90 days before they begin working, with a signed employment contract in hand.

When making eligibility decisions, they often exclude student loans from the applicant’s total debt. But they do require a 5% down payment for their loans.

Read our full Bank of America Physician Mortgages review.

This bank offers 100% financing for their physician mortgages with no PMI and no early payoff penalty.

They offer fixed and variable rates and loans of up to $2 million with a 10% down payment.

Read our full Huntington Physician Mortgages review.

This is one of the only banks that offer physician mortgages for purchases, new constructions, or refinancing.

They also offer loans with no down payment or PMI and a wide range of rate options.

Read our full First National Bank Physician Mortgages review.

Unlike other banks, this physician mortgage program allows doctors to purchase a primary residence as a:

Read our full TD Bank Physician Mortgages review.

This new bank is a merging of two established banks. Their physician loans are available with no down payment with up to $750,000 in loan amount.

Like most banks, your eligible loan amount increases with the amount of down payment you place.

Read our full Truist Physician Mortgages review.

Attending physicians can get a loan of up to $1 million with no down payment from UMB Bank. This is one of the largest amounts offered with 100% financing, although there is one drawback.

Residents aren’t eligible for 100% financing with this bank, which is one of the groups that benefit the most from this type of financing.

Read our full UMB Bank Physician Mortgages review.

KeyBank is another bank that offers physician mortgages to not only new doctors but also established doctors. Yes, even those who’ve been practicing for more than ten years.

Read our full KeyBank Physician Mortgages review.

Fulton Mortgage offers the option to have up to 6% seller-paid closing costs, which can help since those fees rack up quickly. The only downside is that they only offer loans to physicians in a very limited number of states.

Read our full Fulton Mortgage Physician Loans review.

A physician mortgage loan is a wonderful option for new doctors to achieve homeownership.

But it isn’t for everyone.

Before settling on a physician mortgage loan, look at all loan options available and compare mortgage rates. Be sure to read all disclosures before you make your final decision.

Buying your first (or even second) home can be stressful, and the mortgage process can be confusing.

LeverageRx can help you every step of the way, from finding the right lender to getting the best rates for your loan. Talk to a loan officer today!