Unfortunately, doctors are a known target for disability insurance agents. This stems from the confusing nature of the industry, as well the high amount of income doctors need to insure.

Identifying your coverage needs is the first step you need to take to buy physician disability insurance.

But it is not nearly as cut-and-dry as life insurance. Physician disability insurance is full of difficult jargon and gray areas. And doctors aren’t the only ones who struggle with its complexity.

Unfortunately, disability insurance agents often get caught up in this wave of confusion, too. Not a great sign for someone who is supposed to guide you to your most cost-effective coverage options.

Whether he or she is misinformed or just plain unethical, a bad agent will only worsen your disability issues. Here are five ways disability insurance agents have been known to take advantage of doctors in the past (and still do today).

1. Your disability insurance agent does not understand the product

So, what exactly makes physician disability insurance so hard to understand?

Physician disability insurance policies are designed to cover most illnesses and injuries that may limit or prevent you from practicing.

Due to the highly specialized nature of your work, doctors face a higher risk of filing for disability benefits due to:

- Diabetes.

- Back pain.

- Arthritis.

- Blindness.

- Other career-threatening conditions.

Of course, there are various policy term lengths just like any other type of insurance coverage. But there are also various definitions of disability to choose from. This is how insurance companies determine what types of conditions qualify for coverage. And they are extremely specific.

As a doctor, you need an own-occupation definition of disability. This will allow you to work in another profession in the medical field upon becoming disabled while still receiving benefits.

Insurance carriers also categorize doctors according to their area of specialty. This is heavily influenced by:

- How much risk is associated with a medical specialty.

- How difficult it is to return to work in a medical specialty following a disabling condition.

With this in mind, it’s easy to see how an unprepared agent may mislead you to buy a policy that doesn’t match your needs.

2. You take your disability insurance agent at his or her word

Disability insurance agents have a job to do just like like the rest of us.

So it should come as no surprise they are incentivized to increase the cost of your policy to earn a higher commission. As a consumer, this means you are doing yourself an injustice by simply taking the agent at his or her word.

To find an agent you can trust, follow these steps:

- Ask people you trust (friends, family, colleagues) for referrals.

- Check online reviews of that specific agent, as well as any ratings or complaints listed by the Better Business Bureau.

- Determine whether or not the agent represents a credible company. How long has he or she worked there?

But your due diligence shouldn’t end there.

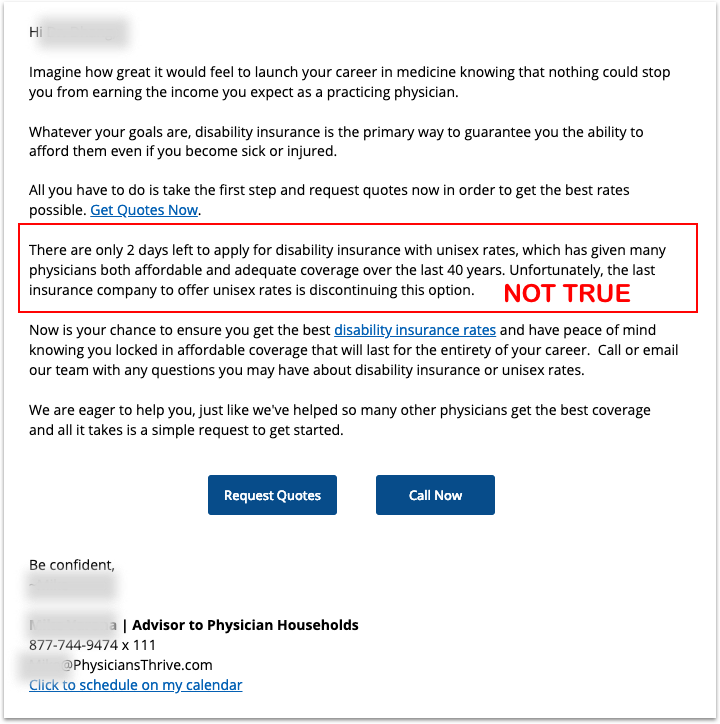

Some unethical agents will blatantly lie and use scare tactics to get you to buy from them. Make sure you compare quotes from multiple agents to get a second opinion and to find the most cost-effective solution.

This broker is blatantly lying and using fear tactics to pressure people to buy. Why? Because doctors fall for these traps.

This once again underscores the importance of vetting your disability insurance agent options.

Ready to check your options?

Compare disability insurance quotes here!

3. You work with an agent who cannot offer discounts

Time and time again, doctors buy disability insurance at full price. More often than not, they are significantly overpaying.

That is because doctors typically have access to various disability insurance discounts. But an experienced broker without access to these discounts may tip-toe around these potential savings. (After all, this is a surefire way to lose your business to a competitor.)

Common savings opportunities include:

- Unisex discounts.

- Medical resident discounts.

- Graduating medical resident discounts.

- American Medical Association (AMA) discounts.

- Disability and life combination discounts.

Before moving forward with an agent, make sure he or she is able to offer these physician discounts. More likely than not, they will also be willing to help you compare rates.

So how do you find a broker like this? Learn how to avoid Mistake #4.

4. You work with a captive agent instead of an independent agent

A licensed, well-informed agent will save you time and effort in securing a strong disability insurance plan. A good agent should help you with research and legwork while offering valuable recommendations.

There are two main types of disability insurance agents:

- Captive agents. A captive broker represents a single insurance company. This individual can only sell you policies from that specific insurance carrier.

- Independent agents. An independent broker works on behalf of multiple disability insurance companies. This individual is unbiased and licensed to sell policies from any insurance carrier it represents.

In both case scenarios, the agents receive a commission as a percentage of total sales made. To avoid getting duped, work with an independent broker. That way, you will have multiple policy options to choose from.

5. You buy products and features you do not truly need

The final way that disability insurance agents trick doctors is by up-selling.

Physician disability insurance features a variety of optional benefits you can add to your policy, known as riders. A good agent will help you pick out the appropriate riders for your coverage needs.

Here are the most common riders you should consider:

- Residual disability. This rider pays benefits if you become disabled but can still work in a limited capacity.

- Catastrophic disability. This rider adds extra funds to your regular disability benefits if you become extremely disabled.

- Cost-of-living-adjustment. This rider ensures that any disability benefits you claim keep pace with inflation.

However, deceptive brokers see this as a lucrative opportunity to push added features on doctors they do not actually need.

This is yet another way malicious agents incite fear to maximize their bottom lines.

Key takeaways

Unfortunately, doctors are a known target for disability insurance agents. This stems from the confusing nature of the industry, as well the high amount of income doctors need to insure.

To prevent this from happening to you, it will help to familiarize yourself with these common traps:

- Working with an agent who lacks knowledge and/or experience.

- Taking your agent at his/her word instead of performing your due diligence.

- Working with an agent who does not have access to physician discounts.

- Selecting a captive agent instead of an independent agent.

- Buying products and features you do not truly need.

So, what’s the best way to avoid them altogether? Get your unbiased rate comparison from the top physician disability insurance companies right here at LeverageRx.